How Supply Constraints, Economic Growth, and Demographics Create a Compelling Case for Multifamily Investment

San Diego’s multifamily real estate market has emerged as one of the nation’s most resilient and attractive investment opportunities, characterized by a remarkable 52% increase in average asking rents over the past decade—significantly outpacing the national average of 38%. While many markets across the country struggle with rising vacancy rates and oversupply, San Diego’s fundamentals remain exceptionally strong with a current vacancy rate of just 5.1%—well below the 8.1% national average. This advantage stems from a unique convergence of factors that continue to fuel demand and constrain supply. As one of the few markets consistently maintaining such low vacancy rates, San Diego has become a magnet for investment capital, driven by enduring structural advantages that show little sign of abating, providing stability in an increasingly uncertain economic landscape.

The Persistent Supply-Demand Imbalance

At the heart of San Diego’s investment appeal is a severe and structural housing shortage that continues to drive rental demand. The city currently faces an estimated deficit of 90,000 housing units, creating a market dynamic that heavily favors property owners and investors.

According to state projections, San Diego needs to construct approximately 13,500 new homes annually through 2029—a total of 108,036 homes—just to keep pace with current demand. However, development has been severely constrained, with only 19,000 new units added in the past five years and roughly 4,000 units delivered in 2024. This represents less than one-third of the annual production needed to address the deficit.

According to Hines’s analysis of Census Bureau and Moody’s data, San Diego is short roughly 90,000 housing units. Chart: Axios Visuals

The barriers to new development remain formidable: restrictive zoning, high land costs, and escalating construction expenses create significant hurdles for developers. These challenges are further compounded by San Diego’s geographical constraints, which make infill developments more complex and costly to execute.

This supply-side constraint has translated into a consistently compressed cap rate environment, even during market downturns, reducing downside risk for developers and investors. For long-term owners of San Diego multifamily assets, this has meant annual rent growth of 4-5% over the past decade, driving outsized appreciation rates and NOI growth.

Economic Vibrancy and Income Growth

San Diego’s economic landscape has transformed dramatically from its historical reliance on tourism and military bases to become a vibrant $315B economy powered by a dynamic mix of innovation sectors, military defense, global trade, world-class education, and entrepreneurship. This economic diversification has catalyzed significant job growth, particularly in high-value sectors.

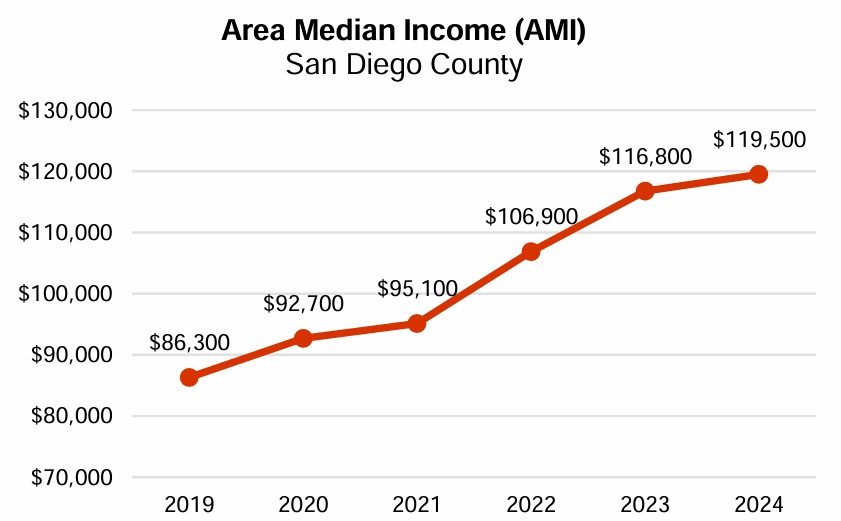

According to HUD, the San Diego Median Area Income has increased 39% over the past five years.

San Diego boasts the nation’s highest wage growth at 4.8% (JLL), while median area income in the San Diego region has surged an impressive 39%, from $86,300 in 2019 to $119,500 in 2024 (HUD), notably outpacing neighboring markets like Los Angeles and San Francisco. This robust income growth directly supports rental rate increases and demand for higher-quality multifamily products.

Often referred to as “Biotech Beach,” San Diego’s life science sector has grown to become the third-largest in the United States ($57.4B GDP), increasingly competitive with Boston and San Francisco. Major players like Pfizer and Illumina maintain significant operations, while tech giants including Apple, Microsoft, Amazon, and Qualcomm have all expanded their presence in recent years. Apple’s announcement of a new 5,000-employee campus further underscores the region’s appeal to major employers.

Shown above: Apple recently acquired the 67-acre corporate campus set to house over 5,000 employees in San Diego.

The venture capital ecosystem has experienced exponential growth, from averaging about $1 billion annually during 2010-2015 to approaching $10 billion in 2021. Despite the national downturn in venture funding post-2021, San Diego has shown remarkable resilience, outperforming major metros including Seattle, Washington D.C., Berlin, and Paris.

Migration Patterns and Demographic Appeal

San Diego continues to attract a steady stream of domestic migrants, particularly from costlier metropolitan areas like San Francisco, New York, Los Angeles, Seattle, and Dallas. U.S. Census data reveals a net influx of over 20,000 domestic migrants to San Diego County annually since 2010, with the strongest net population gains among those with graduate degrees.

The city’s inherent desirability—bolstered by its climate, culture, and quality of life—makes it particularly attractive to young professionals. With Millennials and Gen Z comprising 56% of the population, San Diego ranks second in the U.S. for concentration of millennials relative to total metro population, behind only Austin. This concentration of young adults, combined with San Diego’s 10 major institutions of higher education and significant military presence (employing over 150,000), creates a natural and growing renter pool.

The multi-billion-dollar expansions of San Diego State University and UC San Diego, set to increase enrollment by over 20,000 students, will further strengthen rental demand in the coming years.

Shown above: SDSU recently unveiled plans to build 7 new dorm towers to house nearly 4,500 more students on campus to catch up with the skyrocketing demand for on-campus housing.

Housing Affordability Crisis Drives Rental Demand

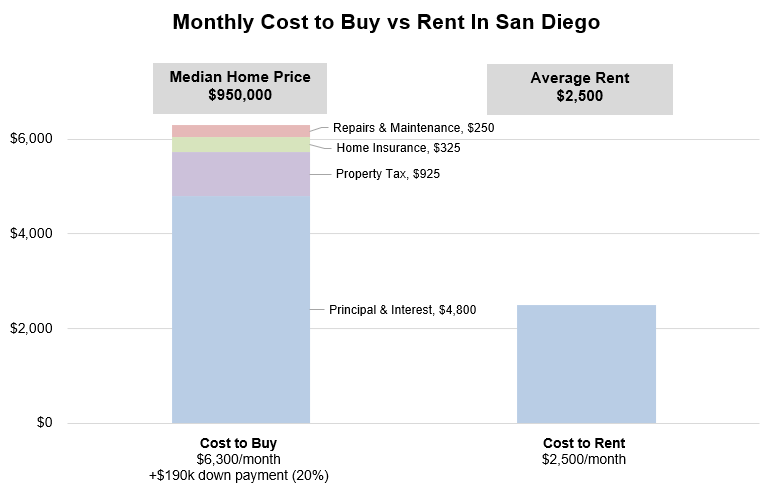

San Diego led the nation in home price growth for much of 2024 according to the S&P Case-Shiller Index, with prices up 5.5% over the past year as of February 2025, bucking the trend of softening prices seen in many other markets. With a median home price of $950,000 as of February 2025, homeownership remains out of reach for many residents.

The cost to own a median priced home is 2.5x higher than the average rent in San Diego.

Today, San Diego families need an income of nearly $275,000 annually to afford a mortgage on a median-priced home, with typical mortgage payments more than double the median rent. Home prices have increased over 35% since pre-COVID levels, while typical monthly payments have doubled due to the combined impact of price appreciation and higher interest rates.

This severe affordability challenge has effectively trapped a large segment of the population in the rental market, including many high-income earners who would traditionally be homebuyers. The result is a rental market characterized by both strong demand and tenants with higher income levels and greater payment reliability.

Low Vacancy Rates Amid National Cooling

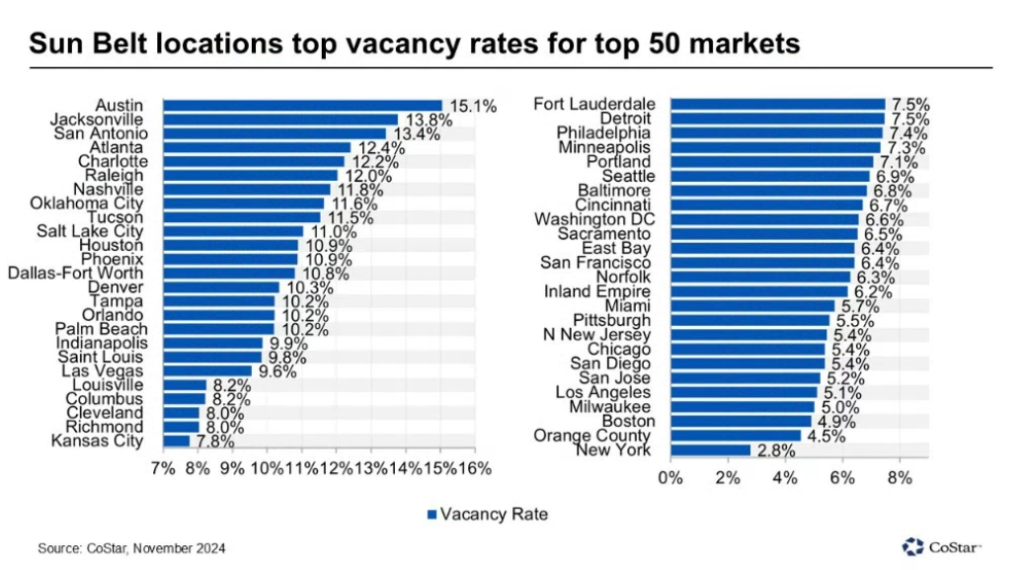

While the national multifamily housing vacancy rate reached 7.9% in Q3 2024, San Diego maintains significantly lower vacancy levels. According to CoStar data, coastal markets like San Diego have dramatically outperformed Sun Belt markets, where oversupply issues have pushed vacancy rates into double digits.

The gap between the highest and lowest vacancy rates among the top 50 U.S. multifamily markets has reached a record 10.6 percentage points. Markets like Austin are experiencing vacancy rates as high as 15.1%, while coastal markets remain much tighter. This divergence underscores the importance of local market fundamentals in driving investment performance.

As of February 2025, San Diego’s multifamily vacancy rate has improved to just 5.1% according to CoStar.

Future Outlook: Continued Strength Amid National Uncertainty

San Diego’s multifamily market is positioned for continued outperformance due to its structural advantages. The combination of persistent housing supply constraints, strong job creation in high-value sectors, and favorable demographic trends will likely maintain upward pressure on rental rates for years to come.

Shown above: Bankers Hill, located in the Balboa Park submarket, has seen a substantial uptick in new development due to recent zoning reforms and the passage of San Diego Complete Communities.

The recent zoning reforms in areas like the Balboa Park submarket and University City, which could potentially double the populations of these neighborhoods through higher-density development, represent an opportunity for developers to capitalize on the market’s strong fundamentals. These reforms, coupled with the Complete Communities program, streamline the entitlement process and provide incentives for affordable housing development.

For investors poised to capitalize on long-term gains, San Diego presents a compelling opportunity in a market characterized by durable demand drivers and limited supply-side risk. While other markets may experience cyclical volatility, San Diego’s inherent advantages position it as a resilient investment option in an uncertain national landscape.

Sources: CoStar, Axios, Redfin, Zillow, San Diego Union-Tribune, U.S. Census Bureau, SANDAG, City of San Diego, Pew Research Center, JLL, S&P Case-Shiller Index